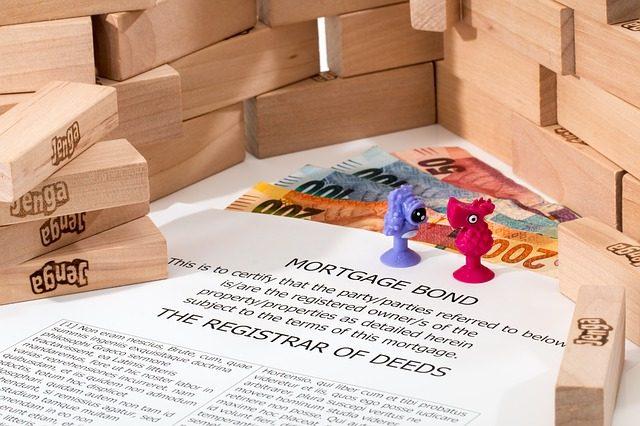

Home Loans: What You Need to Know About Mortgages

Buying a home, although a good investment, can put a tremendous strain on your finances. Actually the monetary cost of buying a house or a piece of property is so large that most people would not be able to pay for it straight from their pockets. This is where a mortgage comes into play. But even though mortgage as a word is usually thrown about when it comes to these kinds of high-profile purchases, few people actually know what it is, let alone know what to look for when they are going to take a mortgage.

A mortgage is defined simply as a loan on a house or some other piece of real estate, but in reality there is a lot more to it than that. It actually comes in a big assortment of types and durations and it can be used not only to purchase a new home or real estate but to also obtain money using real estate as collateral.

But first here are some basics that you should know and look for when looking for a mortgage:

First of all, when you are going to buy a house or a piece or real estate, it would be natural that you will look to a bank or other lender to help you finance the purchase. But these institutions will usually not lend you the entire amount that you need. Thus, the first thing that you should need is a down payment – this is the amount of money that you will personally pay for the property you wish to acquire. This amount will naturally reduce the amount that you need to borrow in your mortgage. Of course, the larger the down payment, the lower your payments will be. In a lot of policies though, the down payment can be as low as 5 per cent of the total value of the property.

Having decided on the amount for the down payment, you can now apply for a mortgage to cover the rest of the amount. The mortgage payments that you will make will be determined by the bank or loaning institution using a system known as PITI, which is broken down as:

Principal

This is the total amount of the loan, and this is calculated by subtracting the down payment from the property’s final price. Of course, the higher the principal, the more you will have to pay back. This means that a higher down payment will result in a lower principal and ultimately, lower monthly payments.

Interest

You are going to be charged with interest on the amount that you have borrowed for the mortgage. The interest will be based on the prevailing interest rates as set by the federal government. It can also depend on the rates that the bank or lending institution is offering. The interest that you are going to pay on your mortgage will be based on the principal amount that you will be borrowing.

Taxes

Buying a piece or real estate means that you will have to pay property taxes. The inability to pay these taxes can result in the government seizing your property. This, of course, would not be to the benefit of the bank or lending institution. It is for this reason that a portion of your property taxes is often added to the monthly payments. This can be placed in escrow – or held for a set duration by a third party – until it is time to pay the property taxes.

Insurance

You will also need to get insurance if you want a bank or lending institution to grant you the mortgage as a way of protecting their “stake” in your property until you have fully paid it off. The amount of insurance that you get will have a serious effect on your monthly payments. A good coverage that involves protection from fire, theft, and acts of nature can reduce your monthly payments significantly. If you have less than 20 per cent paid for in your property, then you would most likely have to get a private mortgage insurance too (also called a PMI). Private mortgage insurance could possibly get rather expensive, so again this perfectly illustrates why it would be a good idea to make a large down payment.

Once the mortgage is approved and the monthly payments have been determined using the PITI system, you now have to pay closer attention to your closing costs. These are additional fees that serve as payment for the work down by the mortgage, realty, and legal teams (of the bank or lending institution), as well as any other applicable taxes and fees that are due when the property is purchased. The closing costs vary depending on where you live and the where the property is located. But expect to pay between 3 to 6 per cent in closing costs. There are lenders though that offer options where you do not have to pay closing costs on real estate loans because the closing costs are absorbed into your mortgage payments.

Don’t think though that there is only one type of mortgage. There are actually three types of mortgage loans that you can possibly access – with each one offering its own unique set of advantages and disadvantages:

Fixed-rate mortgage is a loan that has a set interest rate for the duration of its term. This means that no matter how much the real estate market fluctuates you will pay the same amount for your loan until you have fully paid it. If you were given a low rate on a 20-year loan, then for the duration of those 20 years you will enjoy that low rate no matter how much interest rates rise. The disadvantage though is that if interest rates fall you will still pay the same amount with the same interest rate you were locked in.

Fixed-rate mortgages come in 15-, 20-, and 30-year options. The 30-year mortgage is usually the easiest to qualify for.

An Adjustable-Rate or Balloon mortgage has an interest rate that changes depending on the national rate and market trends. The rate that you pay changes at regular intervals depending on the type of loan you have. This also includes the caps that are in place on the maximum amount that you have to pay based on the increase interest rates.

A balloon mortgage is a little different in that it offers fixed lower interest rates for 5 to 7 years and then you will be required to make a “balloon” payment that will pay off the mortgage in its entirety. The monthly payments will be low but there is that large payment that looms at the end of the term. This is a good plan if you plan on refinancing or selling the property before the balloon payment is due.

Government loans offer much lower interest rates but you usually have to meet certain requirements to qualify. These loans are designed to help low-income individuals, veterans, and people living in rural areas own homes. These loans are processed either through the Federal Housing Administration, the Veterans Administration, or the Rural Housing Service. Each of these agencies have their own qualifications and rules so it is best to consult the appropriate agency to make sure that you qualify.